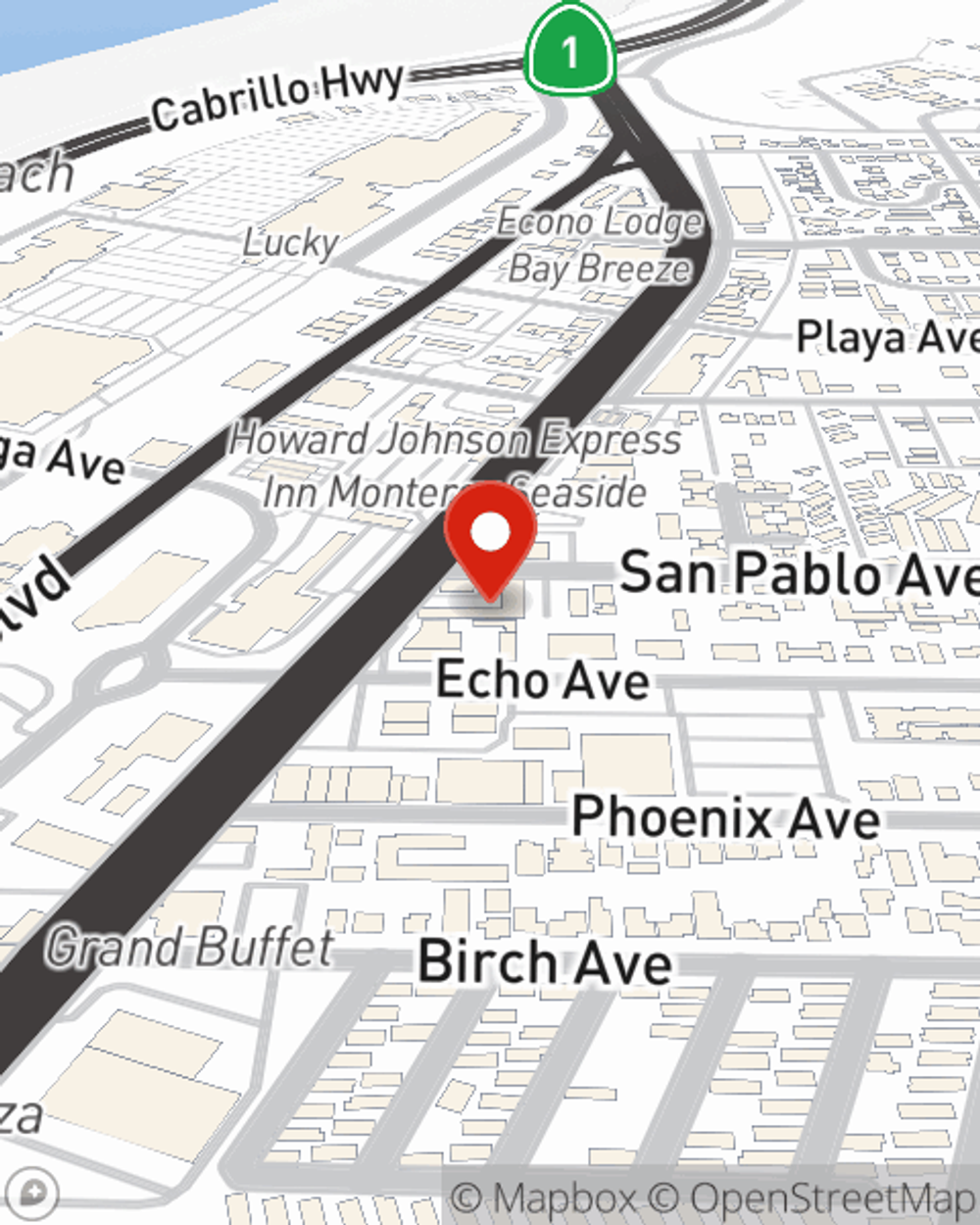

Business Insurance in and around Seaside

Searching for coverage for your business? Look no further than State Farm agent Indy Mahindru!

Cover all the bases for your small business

This Coverage Is Worth It.

As a small business owner, you understand that running a business can be risky. Unfortunately, sometimes catastrophes like a staff member getting hurt can happen on your business's property.

Searching for coverage for your business? Look no further than State Farm agent Indy Mahindru!

Cover all the bases for your small business

Strictly Business With State Farm

With options like worker's compensation for your employees, errors and omissions liability, extra liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Indy Mahindru is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does occur.

Do what's right for your business, your employees, and your customers by visiting State Farm agent Indy Mahindru today to research your business insurance options!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Indy Mahindru

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.